Demo Article

Lorem ipsum dolor sit amet

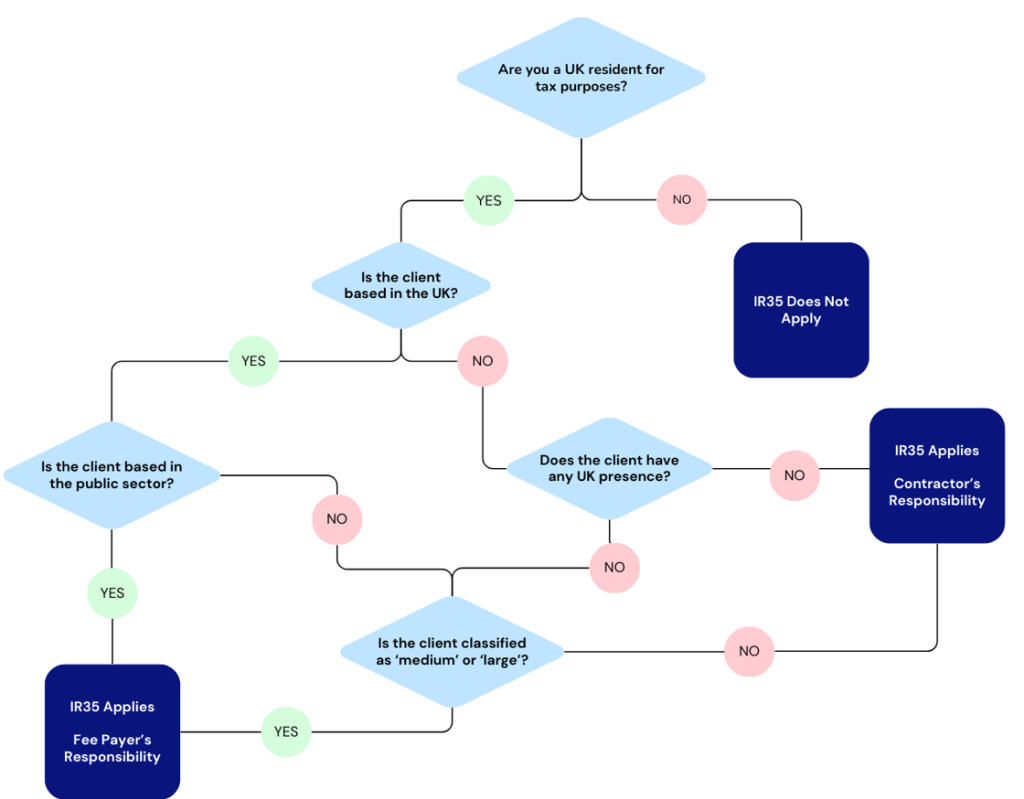

Understanding IR35 and whether you fall inside or outside can be a challenge. Much information surrounds the legislation, its technicalities and how it could impact you as a contractor. Our comprehensive guide covers all you need to know. We’ll answer all of the frequently asked questions, such as “What is IR35?” and “How does IR35 work?” as well as look at the difference between inside IR35 and outside IR35 and how status is determined.

IR35’s nuances mean contractors can’t be expected to know the law inside out. Please only use this article as a guide. If in doubt, refer to HMRC’s website or seek professional advice.

Understanding IR35 and whether you fall inside or outside can be a challenge. Much information surrounds the legislation, its technicalities and how it could impact you as a contractor. Our comprehensive guide covers all you need to know.

Article Tab One

Permanent employees and contractors are treated differently under UK law. If a contractor provides services through their own limited, they may take some of their pay in dividends instead of taxable salary. They can also offset several business expenses against Corporation Tax and pay less in National Insurance Contributions. This lower tax burden reflects the more significant financial risk of being self-employed.

- This lower tax burden reflects the more significant financial risk of being self-employed.

- This lower tax burden reflects the more significant financial risk of being self-employed.

Permanent employees and contractors are treated differently under UK law. If a contractor provides services through their own limited, they may take some of their pay in dividends instead of taxable salary. They can also offset several business expenses against Corporation Tax and pay less in National Insurance Contributions. This lower tax burden reflects the more significant financial risk of being self-employed.

- This lower tax burden reflects the more significant financial risk of being self-employed.

- This lower tax burden reflects the more significant financial risk of being self-employed.

Permanent employees and contractors are treated differently under UK law. If a contractor provides services through their own limited, they may take some of their pay in dividends instead of taxable salary. They can also offset several business expenses against Corporation Tax and pay less in National Insurance Contributions. This lower tax burden reflects the more significant financial risk of being self-employed.

Permanent employees and contractors are treated differently under UK law. If a contractor provides services through their own limited, they may take some of their pay in dividends instead of taxable salary. They can also offset several business expenses against Corporation Tax and pay less in National Insurance Contributions. This lower tax burden reflects the more significant financial risk of being self-employed.

Article Child Tab One

Permanent employees and contractors are treated differently under UK law. If a contractor provides services through their own limited, they may take some of their pay in dividends instead of taxable salary. They can also offset several business expenses against Corporation Tax and pay less in National Insurance Contributions. This lower tax burden reflects the more significant financial risk of being self-employed.

Article Child Tab Two

Permanent employees and contractors are treated differently under UK law. If a contractor provides services through their own limited, they may take some of their pay in dividends instead of taxable salary. They can also offset several business expenses against Corporation Tax and pay less in National Insurance Contributions. This lower tax burden reflects the more significant financial risk of being self-employed.

Permanent employees and contractors are treated differently under UK law. If a contractor provides services through their own limited, they may take some of their pay in dividends instead of taxable salary. They can also offset several business expenses against Corporation Tax and pay less in National Insurance Contributions. This lower tax burden reflects the more significant financial risk of being self-employed.

Article Tab Two

Permanent employees and contractors are treated differently under UK law. If a contractor provides services through their own limited, they may take some of their pay in dividends instead of taxable salary. They can also offset several business expenses against Corporation Tax and pay less in National Insurance Contributions. This lower tax burden reflects the more significant financial risk of being self-employed.

Permanent employees and contractors are treated differently under UK law. If a contractor provides services through their own limited, they may take some of their pay in dividends instead of taxable salary. They can also offset several business expenses against Corporation Tax and pay less in National Insurance Contributions. This lower tax burden reflects the more significant financial risk of being self-employed.

Permanent employees and contractors are treated differently under UK law. If a contractor provides services through their own limited, they may take some of their pay in dividends instead of taxable salary. They can also offset several business expenses against Corporation Tax and pay less in National Insurance Contributions. This lower tax burden reflects the more significant financial risk of being self-employed.

Article Child Tab One

Permanent employees and contractors are treated differently under UK law. If a contractor provides services through their own limited, they may take some of their pay in dividends instead of taxable salary. They can also offset several business expenses against Corporation Tax and pay less in National Insurance Contributions. This lower tax burden reflects the more significant financial risk of being self-employed.

Article Child Tab Two

Permanent employees and contractors are treated differently under UK law. If a contractor provides services through their own limited, they may take some of their pay in dividends instead of taxable salary. They can also offset several business expenses against Corporation Tax and pay less in National Insurance Contributions. This lower tax burden reflects the more significant financial risk of being self-employed.